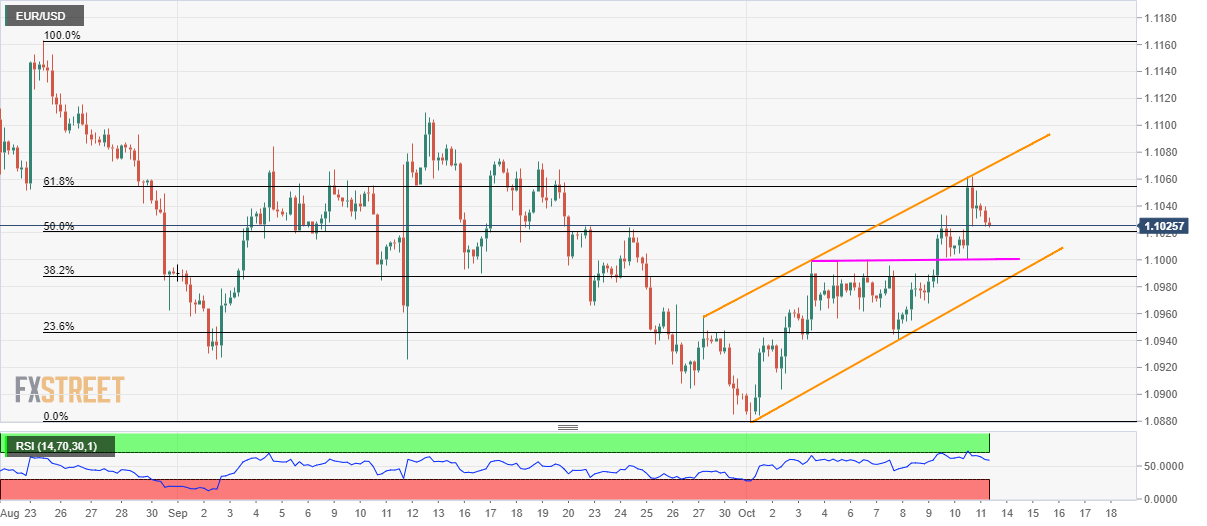

EUR/USD technical analysis: Bulls follow two-week-old ascending channel

- EUR/USD pulls back from 61.8% Fibonacci retracement.

- Sellers look for entry below 1.0980 comprising channel’s support.

Despite witnessing a pullback from 61.8% Fibonacci retracement of late-August to September month declines, the EUR/USD pair stays inside a short-term rising channel as it trades near 1.1027 during early Monday.

While horizontal support including early-month highs and Friday’s low, around 1.1000, can please intra-day sellers, pair’s further declines need to slip beneath support-line of the two-week-old rising channel, at 1.0980, in order lure bears targeting 1.0950 and 1.0900 rest-points.

Alternatively, pair’s upside clearance of 61.8% Fibonacci retracement, close to 1.1055, may find it hard to cross channel’s resistance-line at 1.1070 now.

If at all bulls manage to conquer 1.1070, last month’s high near 1.1110 and August 25 top surrounding 1.1165 could become their favorites.

EUR/USD 4-hour chart

Trend: pullback expected