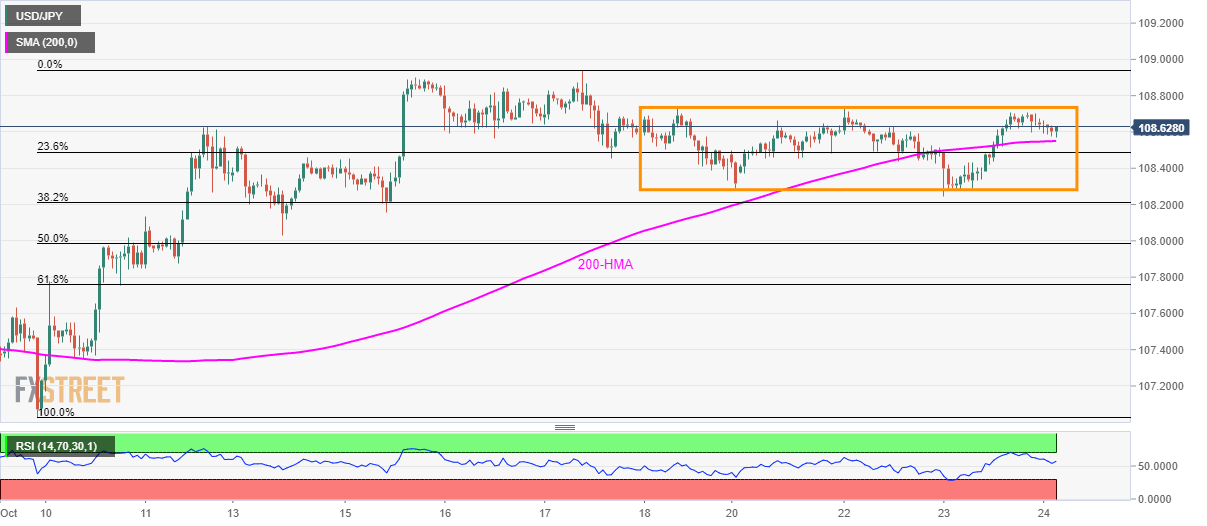

USD/JPY technical analysis: Choppy inside short-term range, more data from Japan awaited

- USD/JPY carries a week-long trading range ignoring early-day PMI.

- 200-HMA can offer immediate support, 109.00 to question the break over resistance.

Following its short-term trading range, the USD/JPY pair takes another U-turn from the range resistance while taking rounds to 108.62 during Thursday’s Asian session.

200-Hour Simple Moving Average (HMA) at 108.55 seems to offer immediate support ahead of the range’s lower-end close to 108.25.

In a case of pair’s further declines below 108.25, prices could drop to 108.00 whereas 107.50 might question bears afterward.

On the upside, pair’s rise past-108.75, including range resistance, could recall 109.00 on the chart. However, August month high near 109.30 may limit the quote’s additional rise.

It’s worth pointing out that after the downbeat performance of Preliminary reading for Jibun Bank Manufacturing PMI for October, 48.5 versus 48.8 forecast, August month Leading Economic Index and Coincident Index will be observed for immediate direction by the Japanese Yen (JPY) traders.

USD/JPY hourly chart

Trend: sideways