AUD/USD Technical Analysis: Buyers take aim at six-week-old rising trendline

- AUD/USD rises to a fresh five-month high.

- The pair sustains trading above the 15-week-old rising trend line.

- Short-term ascending resistance line can question the Bulls amid overbought RSI.

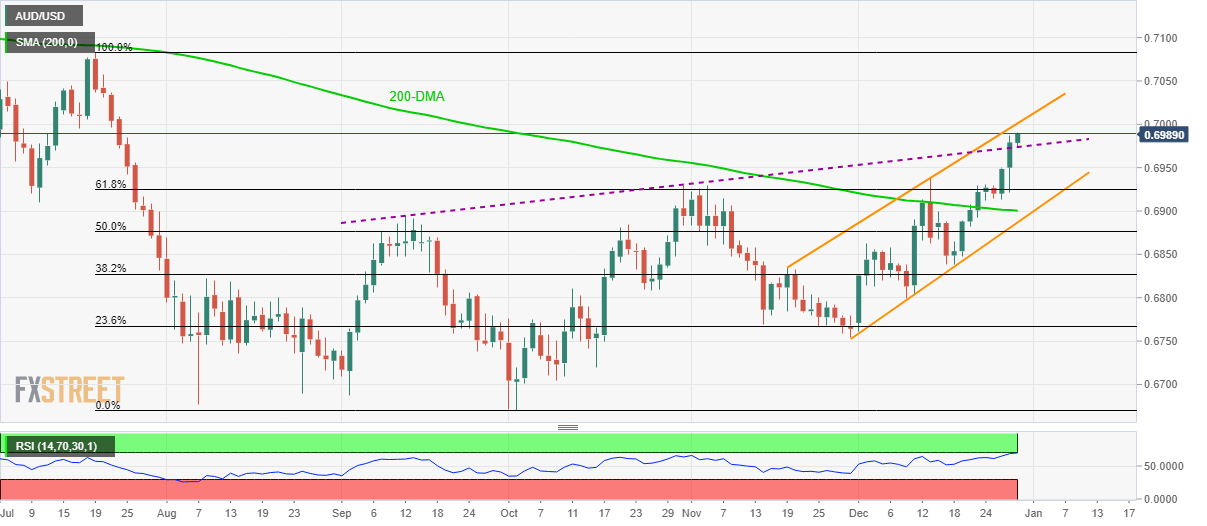

AUD/USD takes the bids to 0.6990, the fresh high since July 24, amid Monday’s Asian session. The pair holds on to strength above the medium-term resistance line while heading towards a multi-week-long trend line. Even so, pair’s further advances are likely to be tamed by overbought conditions of 14-day Relative Strength Index (RSI) and nearness to the key resistance.

As a result, pair’s declines below the resistance-turned-support line stretched since early-September, at 0.6970 now, can trigger fresh pullback towards 61.8% Fibonacci retracement of July-October declines, at 0.6925.

However, 200-day Simple Moving Average (SMA) and ascending trend line since late-November, forming a short-term rising channel, near 0.6900 and 0.6885 respectively, can challenge sellers afterward.

Alternatively, successful trading beyond 0.7000 upside barrier will call for 0.7045 and July month top surrounding 0.7085 to the charts.

AUD/USD daily chart

Trend: Pullback expected