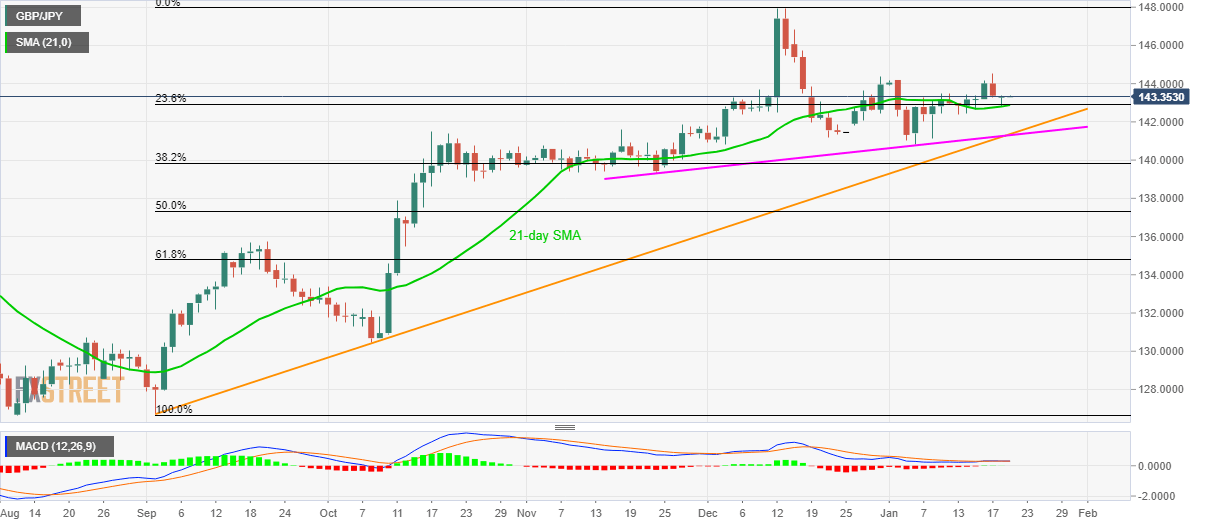

GBP/JPY Price Analysis: 141.40/30 limits near-term downside

- GBP/JPY stays above 21-day SMA for the sixth day in a row.

- A confluence of trend lines stretched since late-November and early September offers strong downside support.

- Higher high since late-December favors gradual recovery.

GBP/JPY registers fewer moves while trading around 143.35 during the early Asian session on Tuesday. The pair recently bounced off 21-day SMA and is well above the key support confluence while portraying a higher high formation since December 19.

With this, GBP/JPY prices are likely to remain firm and flash fresh highs beyond the latest 144.53. In doing so, December 13 low surrounding 145.45/50 and that day’s high close to 148.00 will be on the bull’s radar.

Alternatively, 21-day SMA and 23.6% Fibonacci retracement of the pair’s September-December upside, near 142.90, can act as immediate support before the confluence of multi-month-old rising trend lines question the bears around 141.40/30.

In a case where the quote declines below 141.30 on a daily closing basis, chances of its drop to sub-140.00 area can’t be denied.

GBP/JPY daily chart

Trend: Further recovery expected