AUD/NZD Price Analysis: Extends pullback from 100-day EMA after RBNZ

- AUD/NZD registers the largest losses since November 13 as RBNZ kept the interest rates unchanged.

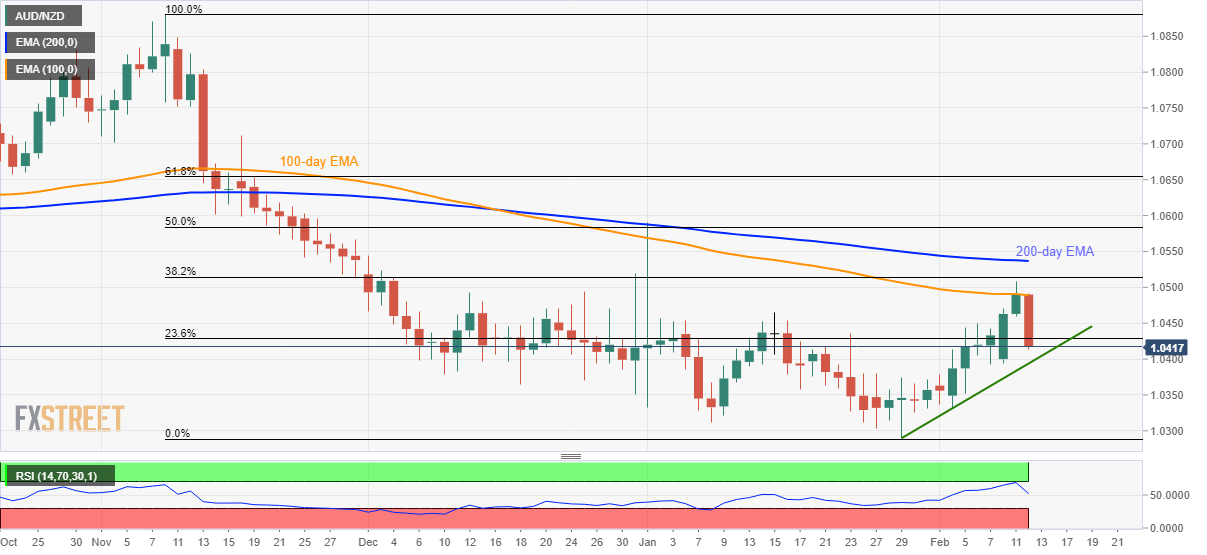

- The pair slips below 23.6% Fibonacci retracement, eyes on a two-week-old support line for now.

- 200-day EMA adds to the resistance.

AUD/NZD drops 0.65% to 1.0420 after the RBNZ matched wide marked expectations of no rate change announcement during Wednesday’s Asian session.

Read: Breaking: A 'hawkish' RBNZ leaves OCR on hold at 1.0% (NZD jumps to 0.6442 resistance)

With that, the quote not only snaps the six-day winning streak but also declines below 23.6% Fibonacci retracement of November 2019 to January 2020 fall.

As a result, sellers may now look towards the monthly rising support line, at 1.0390, as the immediate rest point ahead of multiple supports near 1.0310/300.

Meanwhile, the pair’s sustained run-up beyond a 100-day EMA level of 1.0490 will have to cross 38.2% Fibonacci retracement and 200-day EMA, around 1.0515 and 1.0540 respectively, to recall the buyers.

AUD/NZD daily chart

Trend: Bearish