Silver Price Analysis: XAG/USD bears gearing up for a run towards $25

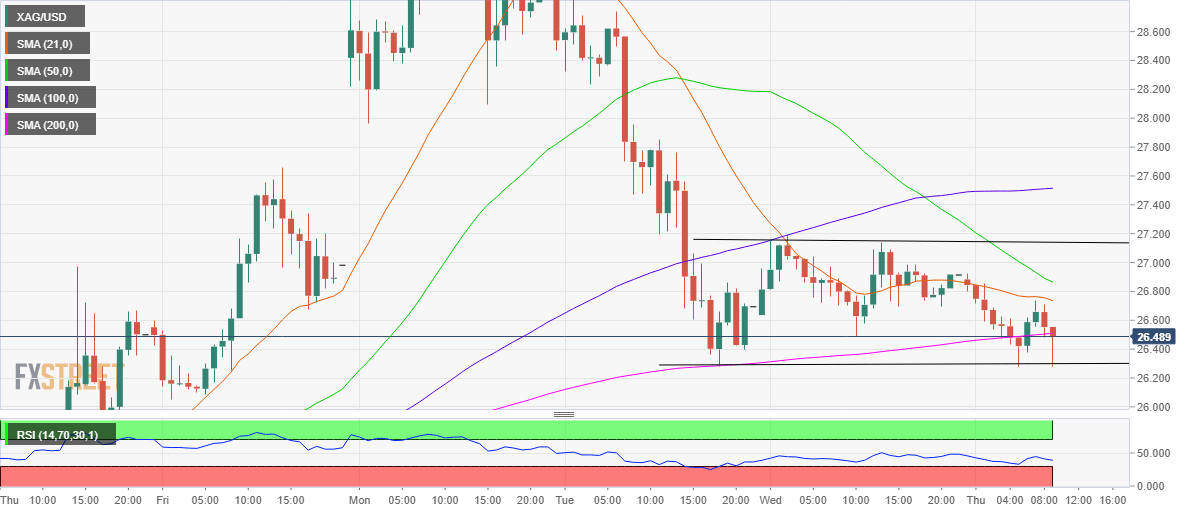

- Silver teases a rectangle breakdown on the hourly sticks.

- Retail-buying frenzy cools off, CME 18% margin weighs.

- XAG bears eye $25 amid bearish RSI.

Silver (XAG/USD) is seeing the ‘sell the bounce’ strategy in play so far this Thursday, as the bulls continue to face rejection on every attempt to regain the $27 mark.

The bears yearn for acceptance below the critical horizontal trendline support at $26.30, which would then confirm a rectangle break down on the hourly chart.

Silver Price Chart: Hourly

The downside break could open floors for a test of the measured target near $25.30, below which the $25 level could come into play.

The Relative Strength Index (RSI) points south below the midline, currently trading at 38.85, indicating that there is more room to the downside.

Alternatively, recapturing the 200-hourly moving average (HMA) at $26.51 would prompt the XAG bulls to take on the 21-HMA barrier at $26.74.

The next crucial hurdle awaits at $26.86, where the bearish 100-HMA lies.

Silver Additional levels