EUR/USD Price Analysis: Mildly offered around mid-1.1900s but short-term rising channel favors bulls

- EUR/USD fades late Friday’s recovery moves, stays depressed since the week-start.

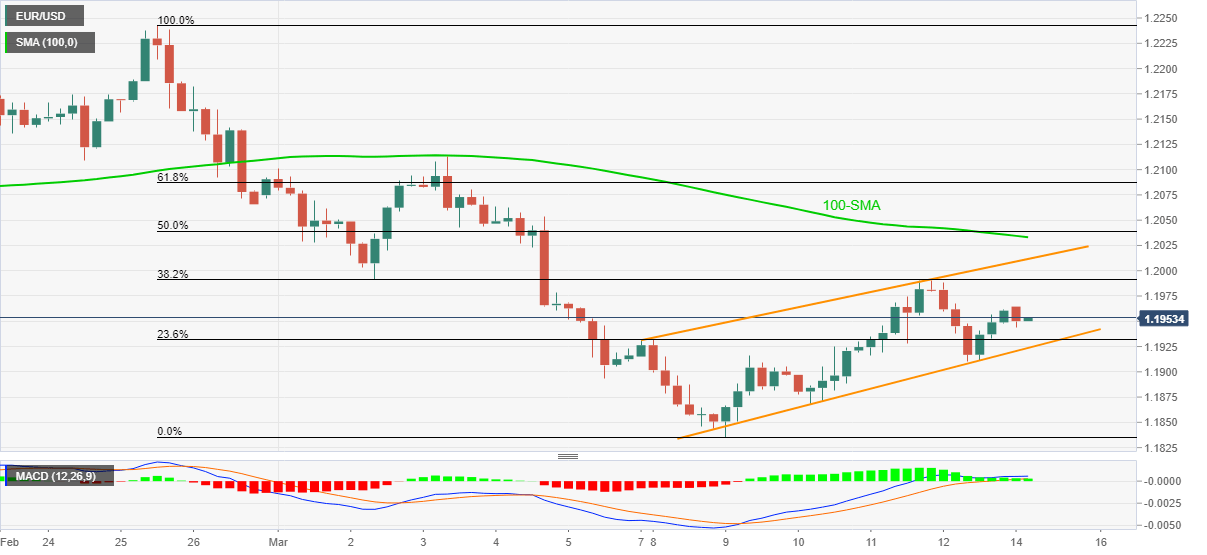

- MACD fades bullish bias below key SMA, suggests further consolidation of gains.

- Bears await a clear rejection of the channel, bulls need to cross 100-SMA for conviction.

EUR/USD wavers around 1.1950 during the initial Asian session trading on Monday. The currency major has been on a recovery mode since last Tuesday, portraying an ascending trend channel bullish pattern, but easing MACD and sustained trading below 100-SMA seems to test the buyers off-late.

As a result, the quote could drop back to test the stated channel’s support line, at 1.1920 now. However, any further downside will reject the bullish formation and can back the EUR/USD sellers targeting the monthly low around 1.1835.

During the fall, the 1.1900 threshold can offer an intermediate halt whereas the pair’s extra fall past-1.1835 will eye for the late November 2020 lows near 1.1745.

Alternatively, March 02 low near 1.1990 and the 1.2000 psychological magnet guard the quote’s immediate upside ahead of the channel’s resistance, currently around 1.2010.

Though, a confluence of 100-SMA and 50% Fibonacci retracement of late February to early March fall, around 1.2035, will be a tough nut to crack for the EUR/USD bulls afterward.

Overall, EUR/USD consolidates early-month losses and hence the latest pullback is less likely to recall sellers unless breaking the channel to the south.

EUR/USD four-hour chart

Trend: Further recovery expected